Trump’s “Death Pledge” Mortgage Proposal Looks Like a Scam—and Black Families Are the Target

Every scammer uses the same pitch: “Trust us, this will make your life easier.” Families across the country face rising rents and homes priced far beyond reach. Groceries cost more, insurance premiums keep rising, and everything eats a bigger share of a paycheck. And then the president floats a new idea: a 50-year home mortgage.

It’s something millions of Americans want to believe. Because the American Dream feels further out of reach than ever and this new proposal looks like it might offer a way in, even as it sets off alarm bells.

The Scam Works Because the Crisis Is Real

People don’t just fall for scams when they’re careless. They fall for them when they’re exhausted, stretched thin, and desperate for relief, especially in a housing market designed to push hope further and further out of reach.

Right at the beginning of the holiday season, when financial anxiety spikes and scams spread, the president floated a 50-year mortgage policy, a message echoed on social media by Bill Pulte, lackey-in-chief of the Federal Housing Finance Agency (FHFA).

The housing affordability crisis is real, and 30-year mortgage products have not delivered the generational wealth–building opportunities promised to American families—especially for Black families. But serious solutions are on the table. Stretching a mortgage to half a century is not one of them.

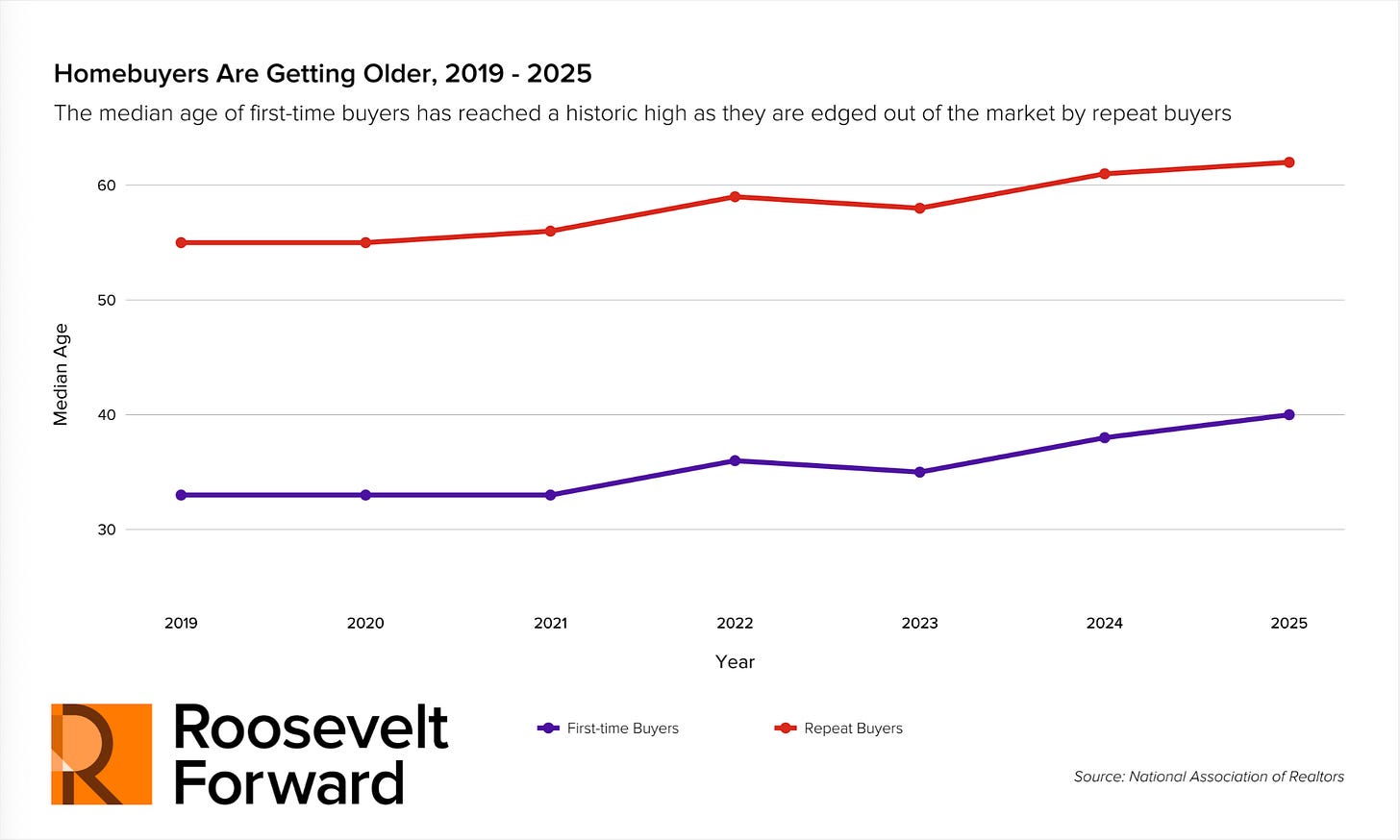

A 50-year mortgage would fundamentally reshape a family’s financial life, especially for Black families. Homeownership remains one of the most powerful pathways to stability and generational wealth. But this proposal would lock Black families into cycles of generational debt and stalled economic mobility. The average life expectancy for Black people is four years lower than that of white people. The median age of first-time homebuyers recently reached an all-time high of 40, while the median age for repeat homebuyers is 62.

The administration’s 50-year proposal is a return to the literal meaning of the word “mortgage”: a death pledge. A 50-year mortgage is a death pledge that follows a family to the grave instead of building something they can pass on. With a 50-year mortgage, someone buying a first home at 40 would most likely die still owing at least a decade of payments without passing down the generational wealth the American Dream promises to homeowners.

A 50-Year Mortgage Turns Today’s Pressures into Generational Debt

As terrible as the implications of this proposal are, the length is not even the most damaging thing about it. Longer mortgages don’t address the factors driving up the real costs of homeownership: insurance and taxes.

A 2025 J.D. Power study found that nearly half of homeowners saw insurer-initiated premium increases last year. Industry data show double-digit premium hikes two years in a row—an 11.6 percent year-over-year increase from 2022 to 2023, followed by an 18.8 percent increase the following year.

Over roughly the same period, property taxes surged. ATTOM’s 2023 US Property Tax Report found that taxes on single-family homes jumped 6.9 percent in a single year, with the average annual bill rising to more than $4,000. Together, these insurance and tax increases outpace inflation and wage growth, quietly driving up the real cost of homeownership even before a family makes a single mortgage payment.

What does this have to do with the 50-year mortgage proposal? It means families would be locking themselves into half a century of payments while additional drivers of housing costs—taxes and insurance—keep rising faster than wages.

A longer mortgage doesn’t shield homeowners from these increases; it exposes them to even more years of them. Instead of providing stability, a 50-year mortgage stretches financial vulnerability across two generations, guaranteeing that families will pay more over time for a home that grows less affordable every year.

Black Families Face Higher Costs and Fewer Protections by Design

But what makes this moment even more alarming is what’s happening alongside the 50-year mortgage proposal.

As the regime tries to sell a multigenerational loan under the guise of “access,” FHFA is simultaneously attempting to eliminate or weaken Special Purpose Credit Programs (SPCPs). These programs were first authorized as a tool for lenders under the Equal Credit Opportunity Act of 1974 to provide flexibility in underwriting criteria and financial support, including assistance with down payments and closing costs, to help marginalized buyers purchase homes.

Although these programs have been around for over 50 years, they have become more popular in the past five years after the Consumer Financial Protection Bureau issued clarifying guidance to help banks establish these programs and remain compliant.

SPCPs exist because discrimination is real, ongoing, and measurable. Black borrowers continue to face higher interest rates, more denials, and biased appraisals, even with the same financial profile as white borrowers. The establishment of SPCPs acknowledged this history of discrimination and showed what can happen when we interrupt those patterns: Black families secure safe, affordable mortgages. They build equity in communities long shut out by redlining.

Yet the Trump FHFA wants them gone. So at the exact moment a 50-year mortgage is being pitched as a path to homeownership, the actual pathways to fair credit and equitable housing access are being dismantled. The communities most harmed by discrimination, especially Black families, are being set up to face a housing market where the only “solution” is a mortgage that outlives them.

This Isn’t a Policy Mistake—It’s Policy Design

Look at the pieces together—the 50-year mortgage, the dismantling of SPCPs, the weakening of civil rights enforcement, the cuts to federal programs—and a pattern emerges. This appears to be a coordinated effort to usher in policies that would disproportionately harm Black communities.

Black homebuyers already carry heavier burdens. We rely more on savings and retirement accounts for down payments. We face lower appraisals and higher interest rates. We fight through discriminatory credit scoring, predatory lending, and decades of policies that made homeownership the primary engine of wealth for white families and the primary barrier for us.

And that is exactly how these policies are designed to work.

This is a coordinated effort to push through policies that would keep Black families indebted, immobile, and economically vulnerable for the next half-century. A country that expects people to take on 50 years of debt while dismantling the programs that make fair access possible isn’t trying to build a stronger future. It’s building a future where fewer people have one.

Fireside Stacks is a weekly newsletter from Roosevelt Forward about progressive politics, policy, and economics. If you enjoyed this installment, consider sharing it with your friends.