Tax-Code Theater Isn’t Health Reform

America is still waiting on President Trump’s “concept of a plan” to reform the Affordable Care Act (ACA), but Senator Josh Hawley (R-MO) recently pitched his own preferred health reform that would allow individuals to write off their medical expenses as a tax deduction. The problem is that, without more, the proposal is yet another unfortunate attempt to address a serious problem with weak tax policy tools.

Tax-Code Tweaks Won’t Solve the Health-Care Affordability Crisis

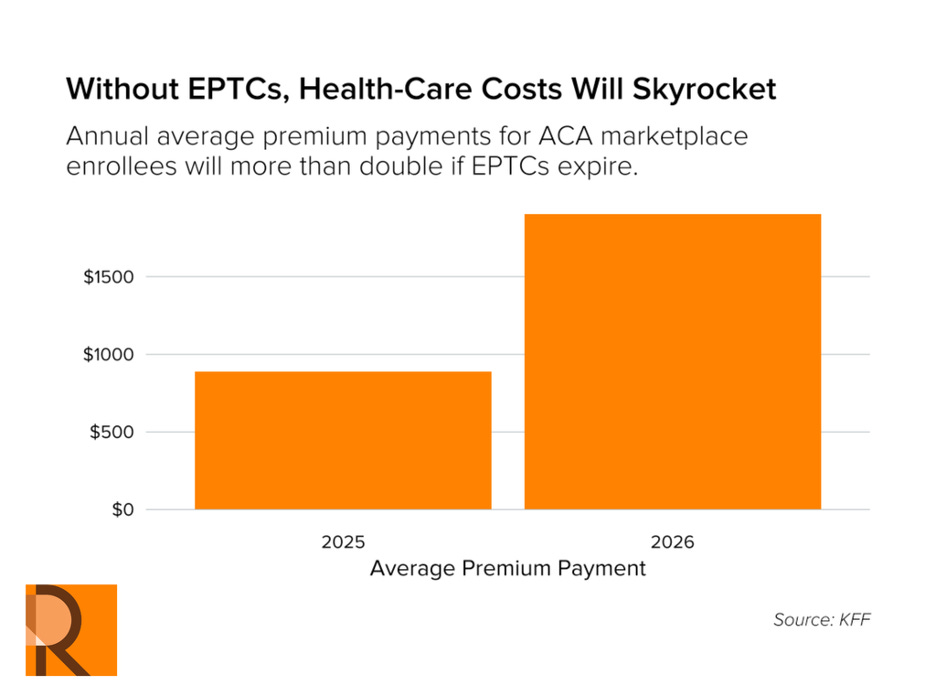

After a historic government shutdown, the battle over the extension of the enhanced ACA subsidies remains unresolved. Now the 24.3 million Americans currently enrolled in ACA plans face massive premium hikes due to the expiration of enhanced premium tax credits (EPTCs). In fact, those currently receiving subsidies (that is, those earning up to 400 percent of the federal poverty level) could face a 114 percent increase in their monthly premium, on average.

To put this in real dollar amounts, a 40-year-old in Pittsburgh, PA, earning $50,000 annually would go from paying $270 per month to paying $415 for a silver plan. And this is happening at a time when people are facing the financial strain of job losses and higher grocery bills.

Sen. Hawley may have voted for the Senate’s recent bill to extend enhanced marketplace subsidies, but he has not been a proponent of making the marketplace stronger for Americans. For instance, despite being familiar with the struggle of those enrolling in health plans during this open enrollment period, recently noting that “health care is just out-of-control expensive,” he has actively campaigned in support of ACA repeal.

So, how would he address these costs?

Hawley’s plan would allow individuals to deduct up to $25,000 per person for medical expenses from the income they report for tax purposes. The deduction doesn’t appear to be refundable, meaning that individuals with no tax liability will see no further benefit from the deduction. This is a shift from the current policy, whereby taxpayers who itemize can deduct unreimbursed medical expenses that exceed 7.5 percent of their adjusted gross income.

This is not the first time that a conservative in Congress has sought to use the tax code to advance policies to address acute needs. Earlier this year Sen. Katie Britt (R-AL) successfully introduced legislation to extend childcare tax credits, allowing for the deduction of up to $7,500 in child care expenses.

While efforts to reduce health-care and childcare costs are a start, reliance on tax deductions as the primary mechanism for reform fails to address some obvious and fundamental problems. Namely, it assumes people will be able to access the benefit in the first place, and that people will have cash to manage these large up-front expenses while they wait for an eventual tax refund. However, much of the American public is not positioned to reap the benefits of this approach to policymaking.

Tax Deductions Don’t Insure People

The Tax Policy Center estimates that 40 percent of Americans will not pay federal income tax in 2025. Thus any tax policy intervention immediately misses a vast swath of Americans who simply won’t claim the benefit (and even if they did, they would get no money back, since Hawley’s health expense deduction does not appear to be refundable).

What’s more, a tax deduction doesn’t help keep people insured on the marketplace as premiums increase. Researchers at the Brookings Institution estimated that 34 percent of marketplace enrollees currently have a $0 net premium, which helps promote health insurance access. In fact, scholars at Harvard University found that compared to Massachusetts’s insurance plans that maintained $0 premiums, those that introduced a nominal monthly premium (under $10 per month) saw enrollment fall by 14 percent.

In addition, reliance on tax deductions is a poor substitute for comprehensive health insurance offered through the ACA. The uninsured don’t benefit from lower rates negotiated with health insurers, and thus often face higher cash prices. With the average American unable to afford a $1,000 emergency expense, it is notable that without insurance, the typical emergency department visit costs in the neighborhood of $2,500. These costs may inevitably overwhelm family’s budgets, strain hospitals’ bottom lines, and force the same families into medical debt.

In fact, challenges with medical debt are felt throughout the US population. The Commonwealth Fund estimates that an astonishing 79 million Americans have problems with medical bills or are paying off medical debt. Those with medical debt are more likely to forgo additional needed medical care to avoid accumulating additional debts, and they often struggle to meet basic needs. And like so many inequities in America, these challenges are not only particularly prominent among the poorest, but also among communities of color and in particular, Black Americans.

What Looks Generous on Paper Will Fail in Practice

Sen. Hawley’s proposal to allow for more expansive deductions for medical care may well be a sincere effort to expand health-care access. However, it reflects a fundamental lack of appreciation for not only the tax filing status of the target population, but also the difficulty that so many face in affording rising health-care costs.

If the average American can’t cover an unexpected $1,000 emergency medical expense, how can they be expected to shoulder up to $25,000 in medical expenses with the hope of recouping that amount when they file their taxes?

Indeed, the maximum deduction in Sen. Hawley’s plan is more than double the out-of-pocket maximum of the average silver plan. And in the meantime, to absorb these additional health-care costs, it will require millions to go into medical debt—putting them at risk of worse credit ratings, among other financial impacts—or forgo or delay needed care. Simply put, this tax deduction is an empty gesture that papers over the systemic harm that is about to unfold for those enrolled in ACA plans.

Without comprehensive and affordable health insurance protections, a seemingly generous tax deduction will still leave behind the millions of Americans who require health care and cannot afford to wait for reimbursement later.

Fireside Stacks is a weekly newsletter from Roosevelt Forward about progressive politics, policy, and economics. If you enjoyed this installment, consider sharing it with your friends.

You seem to be implying that an income deduction would mean they would eventually get the money back come refund time. Are you getting deductions confused with tax credits? I haven’t looked at Hawley’s plan, but a deduction would fall well short of closing the ACA gap even if they had the savings to pay it up front. Once again, Trumplicans are proving they have no plan other than to revert to using ERs as day clinics.